I firmly believe that bringing a child into this world and helping them grow into adulthood is the single greatest achievement we can have as parents. How we educate them, sculpt their lives and bring them from birth to adulthood is one of the most important gifts you can give. I honestly hope we do a great job at this and I know that we’ll give it our all so that our daughter will have the best.

Will alone doesn’t do this. Raising a child is costly and that cost only increases as they get older. Of course, they are worth it, but the reality is that good finances will help to give your child the best start in life. While I would say the greatest investment for your child’s future will be your guidance and time. Today we’ll focus on the finances.

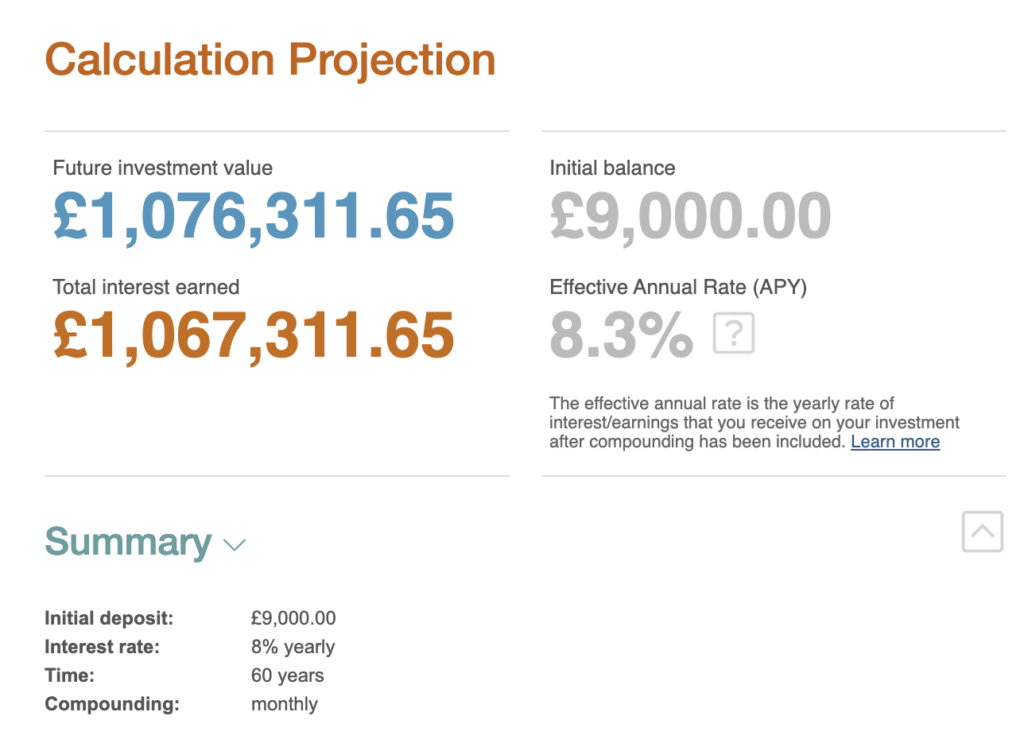

The most important factor to remember when you invest for your child’s future, is that the earlier you start, the longer the investments can grow. We’ll explain later how you can virtually guarantee your child becomes a millionaire with an initial investment of only £9,000. But first and in no particular order, here are some very achievable ways to invest for your child’s future.

1. Piggy bank of dad

One of the best ways to instil great saving and investing habits in your child, is to teach them through their own real world examples. Like every parent, we want to pass on the positive experiences we’ve had and share in the knowledge we’ve gained in our own lives. Talking to a 7 year old about pensions, just won’t cut it though.

In our household money is not a taboo subject. In fact it will be discussed a certain stages quite openly. Money is to be earned and treated with respect. It doesn’t grow on trees you know! Our daughter is well aware that her wishes and Fortnite skins cost money. And once its spent, the money is gone forever. By helping her understand spending, we want our daughter to understand the true value of money.

We also want to teach our daughter that money saved and invested can grow. It can become MORE money and can buy bigger more elaborate things! Now I’m not sending her out to buy a long term rental property. Instead I’m opening the Piggy Bank of Dad. To you and I, this is a spreadsheet. But to our daughter this is her virtual bank account. In goes her pocket money, monetary presents and any earnings she may obtain.

For every pound that remains in her virtual bank account at the end of the month, she will generate 1 penny interest (1%). For the eagle eyed financial buffs among us, this equates to 12% annual interest. If I could guarantee that myself, I’d load up and laugh all the way to the Bahamas.

Whenever our daughter wants to put a deposit in or make a withdrawal from the Piggy Bank of Dad, we call up the spreadsheet. If she wants to buy something and she has the money available, that is her choice.

At the end of each month we tally up the interest received and then the final amount in her account. In very real terms we can see exactly how much our daughter has available and how quickly the money grows or is spent.

This is a great tool to help educate on purchases, saving and investing for a longer time period. At 7 years old, we just want to ensure our daughter values money. But this practice will ensure that as she matures she makes better investing decisions.

2. Junior Stocks & Shares ISA or Junior Cash ISA (JISAs)

Taking things up a notch, you may want to put your child’s savings in to a Junior ISA (JISAs). There are two different types of JISAs. A Junior Cash ISA and a Junior Stocks and Shares ISA. Both provide tax-free savings accounts for under-18s, where they don’t pay tax on interest earned or in the case of stocks and shares investments, on the capital growth.

Many banks and building societies provide pretty competitive interest rates for their Junior Cash ISAs or you can open a Junior Stocks and Shares ISA and invest how you wish.

Your child can have both a Junior Cash ISA and Junior Stocks & Shares ISA in the same tax year. In the 2022/23 tax year, they can put a total of £9,000 into their Junior ISA accounts.

With both types of Junior ISAs, when your child turns 16 they can take control of the account. When your child reaches 18 years old the Junior ISA account converts into a the comparable adult ISA account.

Top TIP: When your child is aged 16 or 17, they can take out an (adult) cash ISA and save up to £20,000 (2022/23) a year, as well as up to £9,000 in a Junior ISA (2022/23).

At age 18, your child has full legal rights to withdraw every penny in their ISA and spend it as they wish. From a young age my parents explained that the money in my Junior ISA was to be used for a significant purchase. Home deposit or for university fees were discussed. I hadn’t considered spending it on frivolous items because its purpose had been explained to me from a young age.

Once the Junior ISA account is opened by a parent or guardian, anyone can contribute up to the yearly tax limit. This counts for parents, friends and relatives. Their contributions or gifts can the grow tax free within the JISA account. As there is no lifetime limit on the value of an ISA any growth can be removed tax free by your child.

How to virtually guarantee your child is a tax free millionaire for only a £9,000 investment

Personally, a Junior Stocks & Shares ISA is the ultimate investment hack for your child and will virtually guarantee their future financial success.

In the tax year your child is born, open a JISA Stocks & Shares account and prioritise their JISA investments. Take any gifts from relatives/friends and then top up the account to hit their £9,000 allowance total. For me, I would personally choose to invest in a low cost index fund. Something like the Vanguard Lifestrategy 100 Equity Fund. Since its inception in 2011, this fund has given an average of 12.68% return on investment. Past performance is of course not an indicator of future performance so I’ll take this back somewhat to a hopeful 8% return.

Now if we just let the investments sit and the magic of compound interest do its thing, then at age 60, your child could have £1,076,311.65 within their ISA and can be withdrawn TAX FREE.

3. Premium bonds

Anyone can buy Premium Bonds for a child under 16. Your child might already have some Premium Bonds as these are often gifted as presents, and that’s fine, they can hold up to £50,000 worth.

Premium bonds are a fun way to save, with the chance to win tax-free prizes each month. If you want to invest for your child’s future and guarantee that your investment is safe, then premium bonds are key. They are the only provider where 100% of your savings are protected.

It is important to note that you are not guaranteed any returns on your savings. If you “win” the draw then the winnings are added to your account. They do not also hedge against inflation and so the value of your savings will likely decrease over a period of time.

4. Children’s pension - Junior SIPP

When choosing to invest for your child’s future, their retirement isn’t likely to be top of the list. But considering time in the market is one of the core factors to compounding growth, it can be a very smart decision, especially if you want to provide intergenerational wealth.

A child’s pension or junior self invested personal pension (SIPP) is a pension designed for those under the age of 18. Any parent or legal guardian can set up a pension for their child, and it will automatically transfer to them when they reach 18.

Although a child is unlikely to have earnings, they can contribute £2,880 a year tax efficiently to their pension. As with adult pensions, the government will top this via tax relief to the amount of 20% on your gross (total) contribution. For their £2,880 contributed, they will receive an additional £720 in their pension account.

At time of writing the pension cannot be drawn until age 57, but as this is likely to rise, assuming a 60 year investing horizon isn’t a stretch for a pension started at birth. If the £3,600 (£2,880 and £720) is invested and achieves an average 8% over 60 years. Without further contribution we would expect it to become £430,285.48. If they contributed and invested a second year £2,880 + £2,880, then £827,815.11 could be achieved at age 60.

For only £5,760 investment your child could achieve £827,815.11 at age 60.

Your child will be able to take 25% of this amount tax free and the remainder of their pension withdrawals are subject to tax at their current tax rate when they withdraw.

There is also a consideration around lifetime allowance in a pension. This may increase or decrease over the next 60 years, so we should always be mindful not to over contribute to a pension.

Want to achieve financial independence?

You could spend the next 13 years learning about personal finance and putting your knowledge into action. Or you could take my FREE 10 day mini course and weekly emails. I’ll show you exactly how to become financially independent. My only question is, whats stopping you?

Final thoughts on how to invest for your child's future

To successfully invest in your child’s future you should not just consider this a financial journey. Educating them on the topic of finances and instilling good habits around saving, budgeting, investing and spending is critical to their own successes. Personally I want to ensure our daughter understands money and its value long before she has access to her investment accounts. She’ll know I will always be on hand to lend some fatherly advice, if she needs it!

Outside of education and understanding, time is the most critical factor when you want to financially invest in your child’s future. The earlier you start, the less it will cost and the greater the potential for returns. My tip for those who want to successfully set their children’s finances off in the right direction is to start at birth. Forgo your own ISA or Pension payment that year and put the money to your child’s account. Once the investment is in motion, let time in the market do its thing.

What are your strategies to invest for your child’s future?

How are you planning to invest for your child’s future? Is there something I have missed in this article or is something out of date or wrong? I’d love to hear your strategies below in the comments section or reach out to me on Twitter.

Here’s to your best future

foundered

Frequently asked questions

If you want to invest for your child’s future over the long term, a Junior ISA provides the best option to grow wealth tax free. Other than an ISA, an Children’s Pension allows your child to grow wealth effectively.

The most effective method to save for your child’s future is through saving and investing within a Junior ISA or Child’s Pension. Each of these accounts are tax efficient and allow your savings and investments to grow.

Time: With time, even the smallest investments can grow incredibly large. Start saving and investing as soon as your child is born. Then let your child’s investments grow over as long a term as possible.