Budgeting is the cornerstone of personal finance. You will hear this from me time and time again. It’s what will make you rich and keep you wealthy over the long term. The best budgets are simple to follow and provide guidance to help you manage your money effectively. Much like diets, there are countless types of budget plans you could follow, but one of the simplest and my personal favourite is the 50/30/20 rule.

What is the 50/30/20 rule?

Many people find the 50/30/20 rule to be the easiest way to manage their monthly and annual budgets. It is simple to understand and follow, but the outcome can be life-changing.

If we look at this pie chart as a representation of the 50/30/20 rule, then up to 50% of your budget will be spent on your essentials. 30% will be allocated to your discretionary spending, and then the final 20% is going towards your savings or paying down your debt.

The 50/30/20 rule is from your after-tax income

The 50/30/20 rule starts with our total after-tax income. If you are employed, then this is the final (net) income you get into your bank each month. If you’re self-employed and you complete a self-assessment each year, then we have to think a little bit in advance. So use your profit minus any expected tax payments that you will need to make. As a general rule, in the UK I suggest allocating about 30% of your profits towards tax. But for higher earners, this could be more.

Now that we have an understanding of our total budget, if your monthly income was £2,000 after tax, you might spend:

- £1,000 on needs

- £600 on wants

- £400 on savings or debts

It’s important to note that this “rule” is guidance. Your situation may vary and that’s just fine. You may not immediately be able to save this amount or cut down some of your living costs, but working towards these amounts is a great goal.

Essential Spending – Needs

Up to 50% of our budget should be spent on needs. But what should be included in this? If we assume that these are essential costs associated with our lives, then needs could include rent/mortgage, utility bills, food, clothing and transport to work. It covers anything we cannot live without.

And that is a very important point. When it comes to your 50% allocated to essential spending, always be mindful as to whether or not this is something you need or something you want. Disney+ and Netflix are not essential. Nor is eating out. A holiday abroad, no matter how much you think you need it, is not essential.

Not having these items might cause you an inconvenience, but you can live a good life without them. However, if we took away your home, then living in the elements could cause physical harm and danger. You may eventually die, and so this would be an essential spend.

Discretionary Spending – Wants

Once we’ve taken care of our needs, we next need to allocate 30% of our budget towards our wants. Do you want to eat lunch out? Do you want to watch Netflix? That is absolutely your choice. If your budget affords it, you can use your discretionary spending to cover any or all of your wants.

We live in a world where the power of advertising and societal pressure stimulates us into keeping up appearances and spend money on things we may not be able to afford. By allocating a certain percentage of our budget and being acutely aware of it, we can live within our means and keep a reign on our finances.

You may look at your essential spending and see categories that could also fall under wants. Yes, you need food to live, but do you need to shop in Marks & Spencer’s or do you need to buy ready meals when cooking from scratch is much cheaper? You may need new clothes to keep you warm or for work, but do you need designer clothing or the latest fashion trends?

I’m here, not to tell you that spending money is bad, but rather to challenge you to be truthful and honest with yourself about your spending habits. Clearly define your needs and wants and hold yourself accountable.

Saving

Saving is critical to protecting yourself from financial emergencies and to building your wealth. Much like a bad diet, we cannot outrun bad spending habits. Consistently putting aside 20% of your pay each month can help you build a better financial future.

What we do with our savings depends on your current financial situation. There is some debate on the order in which you start saving, so these are my opinion and what I would do personally in this situation. I discuss the reasons why, but doing anything is always better than nothing!!!

Building an emergency fund

Have you saved up an emergency fund of 3-6 months of living expenses? If not, this is where we should initially focus our efforts. An emergency fund can protect us from any sudden financial shocks that could impact our financial well-being. A lost job, a car accident or your boiler breaking down are all very real situations many of us will face. Each of these could result in us going into debt or more to cover the cost. An emergency fund can prevent this.

Your emergency fund should consist of 3 to 6 months of your essential living expenses.

In an emergency situation, you would not be expected to save any of your income and in a true emergency, you should look at restricting your discretionary spending. This is an emergency situation after all. If your essential costs are 50% of your income, then we need to save 3-6x this amount as an emergency fund.

Putting this money aside in easily accessible savings or other similar accounts is a great move. As long as you know it is set aside for emergencies and emergencies only.

Example emergency fund

In this example, if you are taking home £2,000 per month, then your essential needs are £1,000 and your emergency fund should be between £3,000 and £6,000. Some of my personal financial coaching clients are happy with the lower end, but in the current climate, many are choosing to increase this for their own peace of mind.

Paying off debt

Some people argue that you should pay down your debt first. Always pay down your debt in accordance with the current terms you have with the providers. However, paying additional money towards your highest-interest debt first can have the biggest impact on the amount you eventually pay

Paying off debt is also important and should be a priority, especially high-interest debt like credit card debt. By allocating 20% of your after-tax income towards debt repayment, you can make progress towards becoming and staying

In my opinion, building an emergency fund takes greater priority than most debt overpayments. In a true emergency situation, any additional debt can put you in a much worse position. With savings to pay for the emergency, you mitigate this.

It is worth noting that you can build an emergency fund and pay down your debt at the same time. And the 50/30/20 rule is just a guideline. You can put more towards your savings rate and secure your financial position as quickly as possible.

Saving

With our needs and wants catered for, our emergency fund filled and debt paid off, the remainder of our income should be put towards our future goals. Make no mistake, saving and investing 20% of your income is huge and will put you in a much better position later in life.

And it’s impressive how quickly the savings can add up. Using our £400 saved each month. This would be nearly £5,000 saved in only a year.

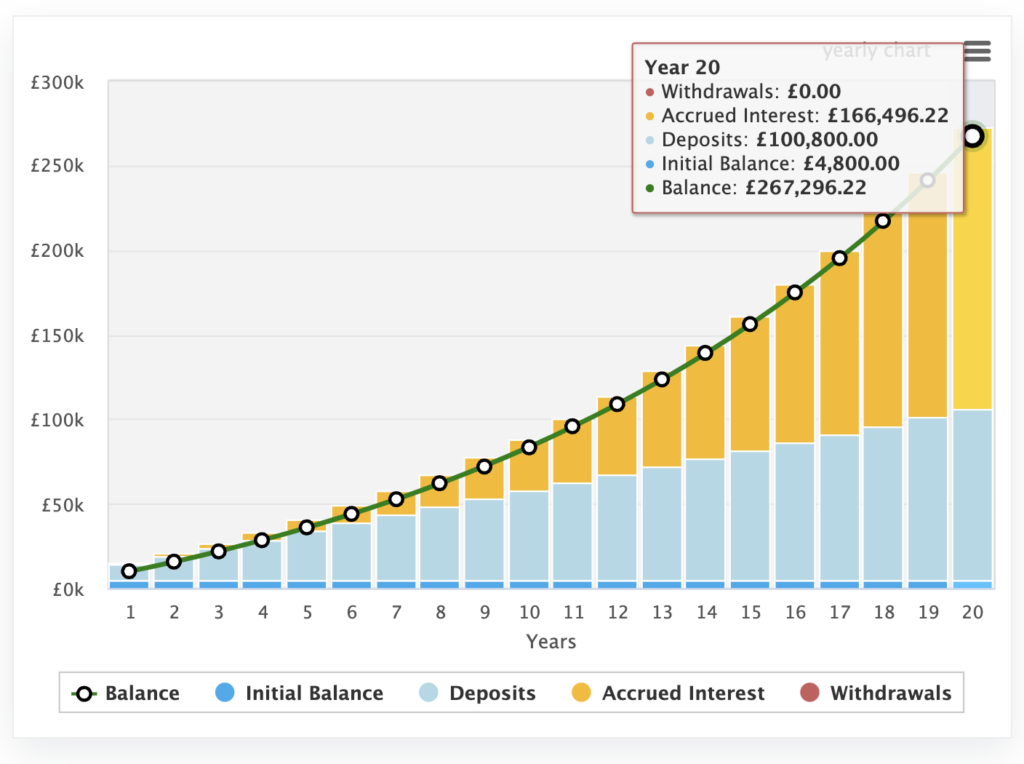

Compound interest

Or if you decided to invest your savings, this amount could become even greater. Using our £400 per month, or £4800 per year, and an 8.5% return on our investment, this could become over £267,000 in 20 years. The power of compound interest that works against you when you are in debt, works for you when you’re investing your money. The goal here is to start as early as you can and to contribute as much as you can to your investments.

Final thoughts

No matter where you are financially today, the takeaway from this video is to get started saving. The 50/30/20 rule is of course just a guideline and may not work for everyone. You can also adjust the percentages to suit your personal circumstances, especially if you want to aggressively pay down debt or save for your early retirement.

However, the 50/30/20 rule is a simple and effective way to manage your money and build wealth. By allocating 50% towards needs, 30% towards wants, and 20% towards savings and debt repayment, you can achieve a healthy balance in your finances.

Want more great content like this? Check out Foundered Money on Youtube.

50/30/20 rule calculator

Necessities: £

Discretionary spending: £

Savings: £