Putting money away for your future often feels like deprivation. Most of us want to enjoy our hard-earned money right this second. Why shouldn’t you? You’ve worked hard and deserve it. Well if you want to retire early or indeed one day, you might need to drastically reconsider your saving and investing plans.

I recently asked my followers on Instagram if they could live on 50% of their income and put the rest of their money to work for them.

It was a loaded question because working with nearly 100 financial coaching clients this year, I could count on one hand how many would be in the position to do this.

The results from the poll were as expected. Almost resoundingly the answer was no! I followed this with a second question because I’ve always wondered why people don’t put money away for the future. Is this a choice or because of the need for that income to live? The question went like this.

If your life depended on it, could you live on 50% of your income?

While the result of this question switched the majority of the previous contributors from no to yes, the numbers were noticeable in that there was over 30% of those who would not be able to survive at this level. For the majority of people who responded, not saving and investing comes down to choice and not a necessity.

Taking both answers into consideration, a lot of us have at least some work to do on our finances and here’s why.

Why are you asking about 50% saving/investing rates?

My audience is primarily in their late 30s or early 40s. Many of them have a great foundation with money put away for their future. Conversely many are starting from zero or close to it. Yet there’s literally no one I speak to who doesn’t want to secure or prepare for their future, even just a little bit.

My ultimate concern is that people aren’t putting enough away for their retirement by a long margin. I’m sharing this post not to shock or scare you into saving, but it should prompt you to consider how much you’re putting towards your retirement plans. Because retirement often comes with the biggest pay cut in your life. And only you can counter that, by taking action now.

I use a 50% savings rate because it sounds like an extreme value to save from your income. Yet when we look at the numbers, a lot of those who completed the survey questions probably need to strive towards this.

Savings rates matter most

Let me introduce Sam and Pam. Both are in their early 40s and hope to retire in their early 60s. Sam earns 200k. To the outside world, Sam is doing great. A big car, flashy holidays and endless dinners out mean Sam spends 160k. He has a savings rate of 20% rate.

Pam earns 50k, and let’s be honest here. She’s also doing great at that income level, but she is able to save and invest 40% each year.

Who do you think will be able to retire first?

Often we think that those with the most income are rich and that they have their finances set, when in reality income isn’t the primary factor in meeting your retirement goals. It can help and certainly does in situations, but your savings rate has a much greater impact than income. Let me show you why.

Assumptions we need to make

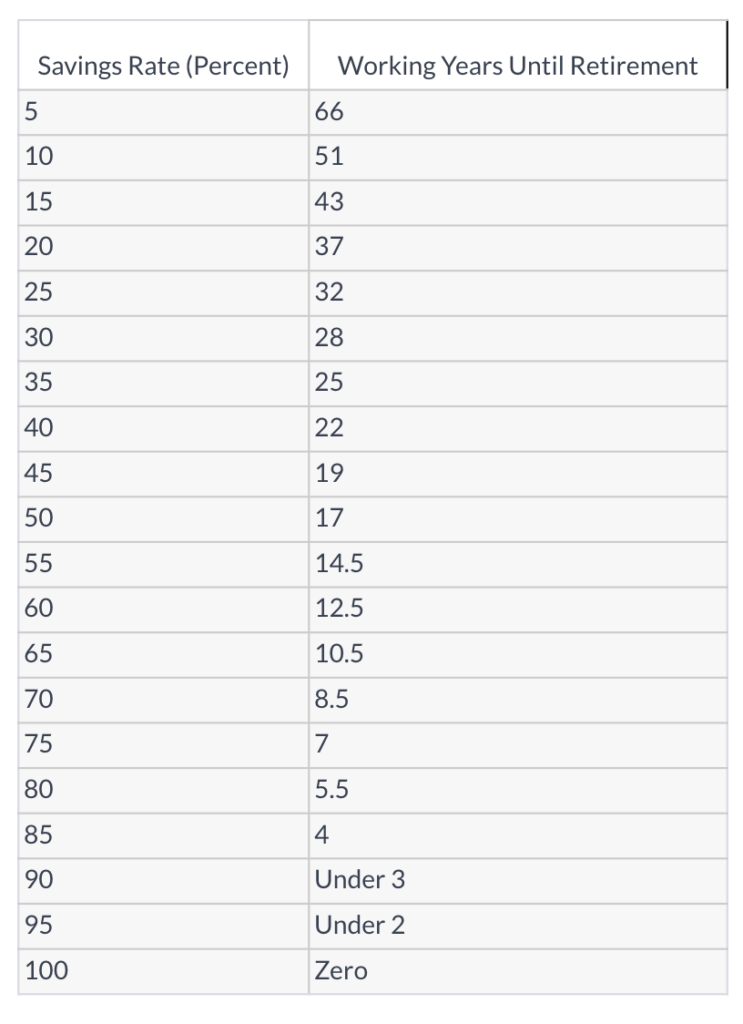

There are a few assumptions in my table on the screen now. We assume that Sam and Pam both invest and receive a 5% annual return on their investments after inflation. We also assume that their retirement withdrawal strategy is the 4% rule.

Sam is able to save and invest 20% of his income from the table above we can see it would take him 37 years to be able to replace his income in retirement. Pam on the other hand with her 40% savings rate would be able to retire in 22 years.

Now there are plenty of other considerations I could add including state pension and inheritances, but in reality, we should be in complete control of our future and only exert control over those factors we can influence. And in this instance, that is our savings rate.

In this scenario, Sam has a considerably larger income, but his expenses have risen to meet his means. Like most people, we’ve built the life we want and it costs the amount that it does. I appreciate this! But if you live to your means now you won’t be able to in retirement.

The reality Sam faces is that if he wants to meet his early retirement goals, he’ll need to make significant changes in lifestyle now when the choice is his and not in retirement when he’s forced to do so.

Let’s look at some other scenarios that might be relevant to you. In each scenario, we’re looking to retire around age 60 and we’re starting with nothing.

Starting at age 20 you should be saving and investing around 15% of your income. At age 30, you’d need to put away 28% of your income. Age 40, around 45%. At age 50, you’ll need to save and invest 65% of your income.

The earlier you start, the smaller the percentage of your income you need to save and invest,

The shockingly simple math behind early retirement

Let’s look at the table again. This table was originally created by a blogger called MrMoney Mustache in his Shockingly Simple Math Behind Early Retirement article. If you’ve spoken to me about retirement for more than a few minutes, you’ll know that this table is what I credit changing my behaviour towards saving and investing money. MrMoneyMustache or MMM explains that the understanding of how much we need to retire focuses not just on how much we earn, but what percentage of this we save and how this affects us not just now, but for the rest of our lives.

For me, the basis of this article focused my early retirement goals on the factors I can control in my life: Earning More, Spending Less, and Investing as much as possible. Something I have continued to this very day.

It does not matter how much you earn, but rather what your saving rate is as you progress through life.

How to retire in 10 years or less

When I speak to my financial coaching clients, I always explain to them that there is no one path that everyone follows and they must choose whether they want to take it slowly and build wealth over decades, or do they want to aggressively pursue early retirement in 10 years or less like I did. In some of those years where I was pursuing financial independence, my savings rate was north of 80% and that sounds extreme. Because it is!

Earning More & Spending Less

Well, it is for most people but at the time it wasn’t for me. I’d gone from a £20,000 salary as an employee to over 6 figures within 2 years. My business was doing quite well, but because I was new to entrepreneurship I was incredibly cautious with spending any of it and decided to put my money out of my reach, by paying down my mortgage and then by putting it into investments.

There are few people who would argue that an 80% savings rate isn’t extreme, but at the time I’d continued the life I had, without inflating my costs and because of this I was able to front-load my investments. This was the catalyst for my own early retirement.

We did start to spend more in the coming years and our savings rate decreased. Looking at the table we would have had an average of 65% to meet the timeline needed to replace our incomes. We didn’t track this closely, but I was always confident that we’d been saving and investing well above 50%.

You’re probably looking at the savings rate table and thinking that you’d never be able to save 80% of that income. My challenge is to ask you why can’t you increase your income while looking at reducing your spending.

You get to make the choice now to focus on and better your financial position. This may feel like a sacrifice and it will be hard, but when you are forced to cut your spending in retirement, I guarantee you, it’ll be a lot harder.

Saving sucks

For those of you who have never focused on saving, I understand that it’ll be tough at first. But giving up a few luxuries now so you can enjoy them again in your later life is completely worth it. I have friends whose reply to this is “What if I die young?” But what if you don’t?

Life is a journey

There are some of you who will go to saving extremes in order to achieve your early retirement goals and this is one of the fastest ways to do so, but it’s no way to live your life.

Penny pinching now often comes at the expense of enjoying life, not to its fullest but sacrificing events that will become lifelong memories. Planning for the future and putting this into action requires knowledge and balance. Knowledge to understand what you need to do and then balance to make sure you stick to the plan without going to extremes on either side.

Best of luck on your journey and if you want more content like this check out the Foundered Money Youtube Channel