Personally I have worked with hundreds, if not thousands of business owners over the past 15 years. Many of these entrepreneurs share common traits such as: passion, determination, endless optimism and focus. They are wholly focused on building their business and creating wealth from entrepreneurship.

One commonality I have noticed is that for the most part, they are always looking for the next opportunity. That’s often a positive but can lead to issues of course. By their very nature, entrepreneurs tend to look at multiple streams of income from their business or variations of it.

They may have a number of independent retail locations, or they provide online courses as well as in person, corporate training for example. They may open offices in new markets or begin offering new products and services to their existing customers.

Each of these are great opportunities and have led to many business owners becoming wealthy far in excess of their financial needs.

Why multiple streams of income is crucial

Many entrepreneurs fall into the trap of having all their income streams being too closely tied to their primary business. Many also consider their business to be their pension. If one fails, everything fails.

Even though I would completely agree that a business is one of the fastest and safest ways to grow a business, entrepreneurs and business owners must also consider that multiple streams of income can come from outside of their primary business. They should focus on not just building multiple streams of income, but balancing these streams for even greater financial success.

In today’s article I explain the 7 streams of income you can build in your own life. You’ll be aware of these no doubt and you may already have multiple streams of income working for you. However, it is always prudent to stop and take stock of where we are and where we want to be.

What if I haven’t started a business yet?

If you are currently in employment, this article is even more applicable to you. Having a singular source of income where you are not the decision maker puts you at the mercy of someone else’s decision making skills.

While entrepreneurship is not for everyone, consider what would happen if your employer failed. Wouldn’t it be wise to have multiple streams of income, not directly linked to your employment?

The benefits of many income streams

Make the 12 paydays a year 50 or 100 paydays

As an employee or owner in your company you are paid on a somewhat regular basis. From the companies’ perspective this is done for cash flow and to match hours worked with a salary payment. Generally this means you are paid monthly or 12 times a year. Generating multiple streams of income will also come with different paydays throughout the year.

In a world where cash is still king, having liquidity to jump on new opportunities is always an advantage.

Mo money, no problems

My wife’s Nana regularly said that “If a problem can be solved by money, it’s’ not a problem”. I’ve used that saying repeatedly myself and I agree with it wholeheartedly.

Need to have an operation? A private clinic will see you within days. Need to get home in a hurry? Money will get you there. While having wealth won’t fix every problem, it certainly mitigates a lot of the risk, most of the time.

Diversification

Like asset allocation in your portfolio, multiple streams of income allows you to have a balanced income strategy. This will make you less susceptible to financial challenges you might face through diversification. Did your business make less profit this year? Were your rental properties occupied? Did your living expenses increase? Being diversified means greater safety from outside factors.

Should you fall sick or be unable to work, having multiple streams of income outside of your primary income or employment also provides financial stability.

Greater wealth

Consider each income stream as an independent profit centre in your personal empire. Putting your assets to work, while continuing to build other income streams, they will work collectively and the efforts will compound to add to your overall wealth.

Flexibility

As you build multiple income streams, a certain level of flexibility also grows. The active sources of income such as your businesses which did the heavy lifting initially, start to balance out their contribution against the more passive income streams such as interest, dividends and royalties or rentals.

Without the same level of reliance on earned income to meet your financial needs you may be able to reduce your working hours or work remotely for extended periods of time.

Alternatively you may double down and let all streams of income work cohesively to build wealth faster to retire early. The choice is yours.

Want to achieve financial independence?

You could spend the next 13 years learning about personal finance and putting your knowledge into action. Or you could take my FREE 10 day mini course and weekly emails. I’ll show you exactly how to become financially independent. My only question is, whats stopping you?

7 Streams of Multiple Income

How many streams of income are you aware of? How many streams do you have already? The chances are you’ve more than one already created. To achieve financial freedom as efficiently as possible it makes sense to continue adding more throughout your life. You can do this at any time, so don’t rush and concentrate your efforts where it makes sense to.

What are the seven multiple streams of income?

Everyone, even the most highly paid professionals or business owners should consider creating multiple streams of income and there’s a high probability that you’ve already begun this journey. That’s amazing!

Below we’ve outlined the 7 multiple streams of income that will help you create financial freedom and security. Build these into your personal financial plan and watch your wealth grow faster than ever.

- Earned income – Income from employment or primary business

- Income from side hustles

- Rental income

- Royalties – Income from products created

- Interest income

- Capital gains

- Dividends income

Earned income

Earned income is income generated through your primary employment or business. It is the least passive of the income streams, but also has the greatest impact on your wealth at the beginning of your personal finance journey. Without it we would not have the foundations to build towards financial freedom.

For those in employment, if you want to earn more income you need to work more hours. Your job is to make money for your employer. Maximise your earning potential within your employment

Ways to increase your earned income within employment

- Ask for a raise and deserve to get one

- Move to a new employer

- Upskill into a different role

- Work more hours

The alternative is to start a business. Starting a business does come with risk and it’s not for everyone, but it gives you the opportunity to earn infinitely more than you would for someone else. Business owners want to maximise their profits and this can be achieved by increasing turnover and reducing costs.

Income from side hustles

Repeat after me. Not every hobby needs to become a side-hustle.

Say it louder for the people in the back.

As an entrepreneur, I look for ways to monetise everything. Side hustles often come from your passion projects or through activities you enjoy.

One client of mine in the food manufacturing industry also runs an electric karting business (started well before the electric craze of late). He grew up in the sport of Karting and he’s bringing that passion to life through his side hustle. Done correctly this will add additional income, reduce his cost in the sport and provide tax benefits.

Stuck for side hustle ideas?

Rental income

Purchasing a rental property or multiple properties is an excellent way to diversify your investments and to generate income from rent.

Passing over the responsibility of managing the property to a rental agent allows this income stream to be relatively passive. I purchased my first rental property at the start of this year and after 8 months I have spent 11hrs “working” on the property.

Mostly this has been phone calls to contractors who were managing the basic work that was required to have it ready for tenants.

For someone who wants a completely hands-off approach to real estate investing, they could invest in a real estate investment trust (REIT). A REIT is a property investment company which, very broadly, simulates direct investment in UK properties.

Royalties or passive income

Traditionally royalties came from the licensing of your intellectual property. Artists receive royalties on their music, writers on their published books. Some businesses receive royalties on their use of their patents or trademarks.

Today you can create your own digital items and sell them time and time again. Self publish on Amazon Kindle Desktop Publishing or sell your designs on Creative Market. You can even sell courses to your audience. The world of royalties and passive income now intersect and anytime you create a digital asset, you can sell this. The key is to create something of value that people want to buy.

Interest income

Interest income is the amount paid to you by your bank, building society or a Peer 2 Peer lending company for lending your money to them. Additionally purchasing government bonds provides a fixed interest income.

There is a time and place for focusing on interest income and this usually comes when you are looking for security and safety at the tail end of your financial independence journey. Interest income usually provides a lot lower return on investment than the other multiple streams of income mentioned.

However the stability it provides to your finances, means we should always give it consideration.

The opportunity cost earlier in your journey is that the money tied up to achieve interest could be put to business opportunities, investments or rental properties. All of which have a potential for greater wealth building.

Capital gains

When we invest in an asset, one of the main goals of doing so is for that asset to appreciate in value. This could be a business asset where we actively have an input or a passive investment we have made in the stock market.

When we move to sell the investment that has appreciated, this is called capital gains. It’s mindful to understand capital gains tax allowances in the UK. These fall outside of income tax and are a great opportunity to generate income.

The value of your investments can decrease as well as rise though!

Dividends income

Outside of the appreciation of our investments, many companies also provide dividends. A dividend is a reward paid to the shareholders for their investment in a company. It usually originates from the company’s net profits. Dividends are usually paid regularly such as once a year or quarterly.

While in the wealth generation phase of the financial independence journey, many investors choose to reinvest their dividends over the long term to avail of the benefits of compound interest.

Balancing your income streams

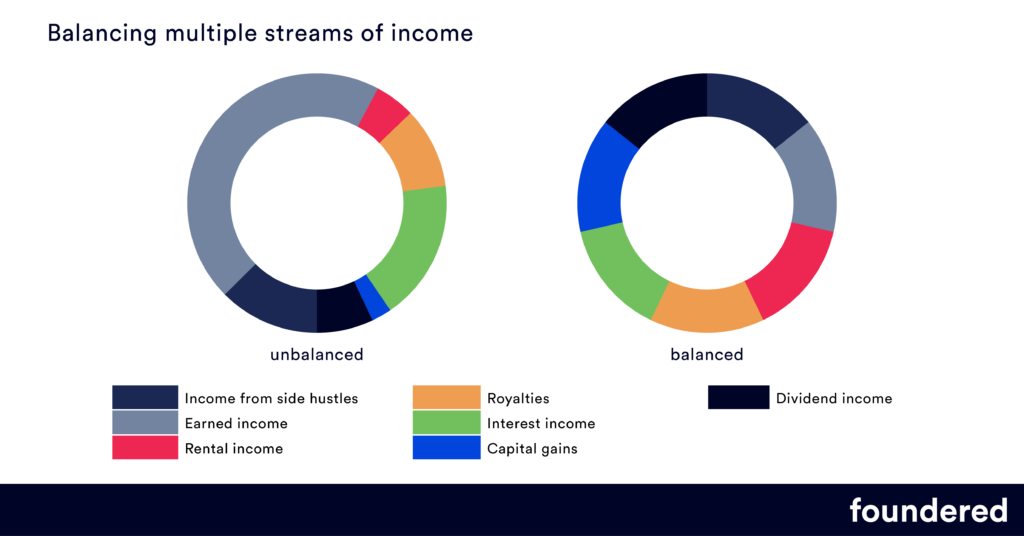

In the charts below we’ve plotted an example of many peoples income streams. Some will provide the lion’s share of wealth creation and others lesser so. These charts should be fluid throughout the course of your financial journey and each income stream will jockey for position with every payday.

Balancing the value of your multiple streams of income reduces your risk should any of them fail or fail to deliver the results you expect. With that said, some income streams will grow larger than others over time due to compound interest. Others will be able to grow from your efforts (business) and some side hustles will stay relatively small by their very make up.

So while an admiral goal to balance, the real world may differ significantly. Being diversified through multiple streams of income however, is key.

Challenges to creating multiple streams of income

The opportunities of creating multiple streams of income noted above should be enough to get you thinking about this seriously. However like most things, with opportunities come challenges. These include:

- Spreading yourself too thin – systemise and automate what you can but focus on where your input can make the most impact first. Once you have that systemised move onto the other income streams.

- Investment required – some streams of income require significant investment or tying up your money for a period of time. This could lower your overall wealth by comparison to what you could have achieved, if not managed correctly.

- Continuous evolution of skills and learning new concepts – These multiple streams of income come with a warning. You will need to learn new skills and put them into practice as you progress in your journey.

- It won’t happen overnight – Nor should it. Understand and make peace with the fact that this is a journey. Learn to love it. The good and the bad.

Final thoughts

There are stages to creating multiple streams of income and progressing through them should be celebrated. Your focus and input required will peak and trough also. But knowing this and building out each of the income streams will ensure the best opportunity for financial success.

Want to get in touch? Please feel free to reach out on Twitter. Alternatively, I’d love for you to leave a comment below.