Today we are going to delve into the concept of “Coast FIRE”, the second stage on the path towards Financial Independence. If you want to start at the beginning of this series, check out my Lean Fire article/video which I’ll share in the show notes below.

Remember, financial independence isn’t a one-size-fits-all journey. The question of “How much is enough?” will be answered differently by each of us based on our unique needs and circumstances. Everyone’s path towards financial independence will vary, but the distinct stages marking your progress will stay constant.

When I first embarked on my journey towards financial freedom, there was only one type of FIRE. It was the stage where you had enough saved and invested to cover your annual expenditure indefinitely. For many of my viewers, who follow the 4% withdrawal rule, this would be when your investments total 25x your annual expenditure.

However, in today’s world, numerous types of Financial Independence have evolved, including Coast FIRE, Lean FIRE, Chubby FIRE, and Fat FIRE. Each of these is an extension or reduction of the typical FIRE goal, serving as milestones to track progress and provide motivation along the way.

Some might find Lean FIRE too restrictive budget-wise and that’s just fine, while Fat FIRE could be unreachable due to earnings potential or your desired retirement timeline. Remember, this journey is personal to you and you alone.

As someone who has achieved my own version of financial independence and retired early at the age of 40, I can only tell you that every choice you make now is totally worth it. Delaying gratification is one of the hardest things you will ever accomplish, but on the other side, it’s amazing. Every day feels like a Thursday and schedules that once regimented my life are so few and far between. I’m not saying it’s perfect, but it’s pretty close and I highly recommend it.

Don’t forget to stay tuned for my upcoming articles/videos where I will discuss all the other stages of financial independence including a new concept: “McDonald’s FIRE”. eeek

Today though, we will deep dive into Coast FIRE, examining its pros and cons, and helping you to determine if it suits your own life goals. We will also explore the financial calculations needed to work out how much you need for Coast FIRE and importantly when you can stop contributing to your investment accounts FOREVER.

The aim of each FIRE article in this series is to provide you with enough information and understanding, helping you to make informed decisions about your financial independence journey and inspiring you to take action. If you find this video useful, please do leave a comment below and if you think it may benefit someone else, feel free to share it with them.

Definition of Coast FIRE

There are a number of definitions of Coast FIRE online. Some say it’s akin to a normal working career where you work, save and invest to eventually retire. While I partially agree, I believe Coast FIRE involves a shorter working life with an early focus on building a suitable nest egg that will grow over time to support your early retirement aspirations. At this point, you can choose to move into a lower-stress or lower-paying job that meets your current needs, while your investments grow.

Calculating your Coast FIRE figure

Coast FIRE can happen when your investments will one day meet your Traditional FIRE goals, without any further money being added to your investments. I appreciate that this may be a little confusing at first, so let’s break that down a little further.

If our normal financial independence number was 40,000 per year. Then using our 25x from the 4% rule, we would need 1 million saved and invested to consider ourselves as traditionally financially independent.

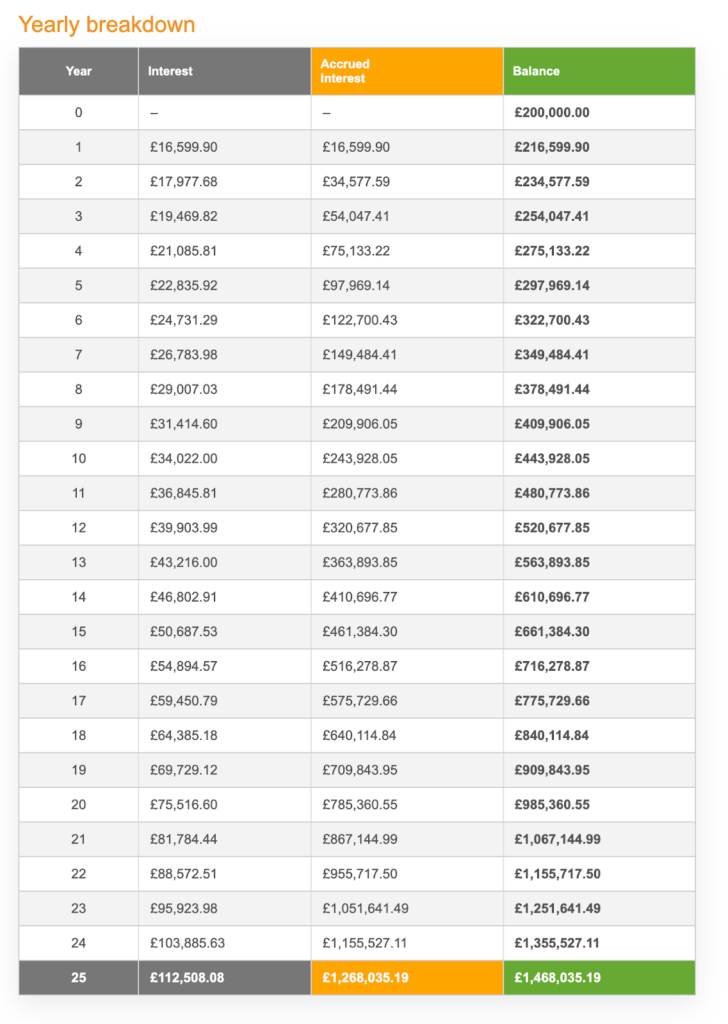

However, we may consider ourselves Coast FIRE, whenever the value of our Investments is significantly lower than this. The table shown here is an example of an investment account that is currently at a level of 200,000.

Without adding any further money to this investment pot, and on the understanding that we hope to achieve an 8% return. Then without any further money invested, our investment should grow to meet our traditional fire number in 21 years. This means that we only need to earn enough money in this period to cover our expenses until such time that our investments meet our living needs.

Saving vs investing

In my example, I have used an 8% rate overturn on our investments, and it is important to note that the money in this example is invested, not just saved. If you are new to your financial freedom journey, many of those before you have chosen to invest their money with the aim of generating a greater return on this investment.

If you were to save money in a bank, you could expect a three or four per cent return on your savings, however by investing your money in the stock market, we generally expect a larger percentage return over the long-term. My own investments have achieved an average of greater than 11% over the past 10 years. That’s including taking into account the 30% drop due to the pandemic a couple of years ago.

However, using the same example as before but with a three per cent return on your investment each year, it would now take us 54 years to achieve our financial independence goals. There is no guarantee that the money invested will outperform your money saved. Historically though, putting your money to work for you through investments would have been the more prudent choice.

Investing is also incredibly important in the fight against inflation. As an investor, we use our money to buy assets that benefit from inflation or at least keep up with its pace. At a fixed rate of return, savings are more susceptible to inflationary changes.

Drawbacks of Coast FIRE

Much like going to the gym is good for your well-being, there are relatively few drawbacks to saving and investing money for your retirement goals. But there are some that I must point out for the sake of objectivity.

You may not have enough

Your investments may go up and they may go down over the years. Overall we would hope that the trajectory is up and to the right over many decades. With that said, your investments may not meet your needs in retirement. This could be because your spending has increased, or the investments haven’t achieved the expected return.

Demotivate you towards work

When you know you’re retirement is taken care of, a lot of the fucks given about work, go out the window. And I appreciate that this should be the case for the most part anyway. But what if you are leaving your life’s work and great potential behind? What if you could have created a life-saving treatment or drug that cured cancer?

This is probably the question I ask myself the most. Have I more to give? Am I being selfish for retiring early? These are likely questions you’ll have to ask yourself also.

You might die

Around 1 in 5 of us will die before the age of 60. Sacrificing your lifestyle now comes at a cost and there is a chance that you may not live to access and spend your money in retirement.

I know, I know. Any happy stories Connor? Well actually yes I do! As there are some amazing benefits of focusing on Coast FIRE.

Benefits of Coast Fire

The shortcut to retirement

Saving for retirement can often seem daunting. It may feel like an endless treadmill from which there is no escape. However, Coast FIRE (Financial Independence, Retire Early) offers an alternative route. By choosing to save aggressively for a short period early in their careers, many individuals are able to step off this metaphorical treadmill. They allow time and their investments to do the heavy lifting and with the magic of compound interest, their wealth grows significantly.

Living an intentional lifestyle

If you’re in your 40s, or 50s and have found out about Coast FIRE at a later stage in life, achieving Coast FI will require greater contributions as early as possible. But in doing so and focusing on Coast FIRE, reaching this goal and no longer having to contribute to your retirement nest egg provides a level of freedom, allowing you to be intentional with your remaining working years.

Change careers

Many individuals I know, who are on their journey towards Coast FIRE, have significantly improved their lives upon reaching their targeted “coast” number. Some have opted to reduce their working hours, while others have managed to transition into a single-income family. Generally, these people enjoy more flexibility to live a life of purpose, pursuing careers they genuinely want to work in, versus jobs that pay their bills.

Calculating your Coast Fire number (practical examples)

There are two key variables when planning for Coast FIRE. The first is the amount of money that you can invest, and the second is the length of time available for investing this money. The longer we allow our investments to grow, the less we need to invest.

Let’s consider a retirement plan that requires £40,000 per year. We would eventually need a retirement pot of £1 million, based on the 4% Rule which is 25x our annual budget. If we assume an average 8% return on our investments over the lifetime of our investment horizon, we can approximate some real-world scenarios at different ages, planning to retire at a traditional retirement age of 68.

Coast FIRE example one – Tony

Tony, 20, has 48 years until retirement. Using our compound interest example, it would take 38 years for £50,000 to reach £1 million at 8% compound growth. This means Tony has 10 years of saving and investing to eventually retire a millionaire. You might think that he needs to save £5,000 per year, but with compound interest, the amount is even less. In fact, it’s only £3,000 over each of the first 10 years.

Coast FIRE example two – Charlene

Charlene, 35, has 33 years until retirement age. She recently inherited some money and is willing to put £75,000 away for her Coast FIRE plans. Without any further contributions, she will be able to achieve traditional FIRE with only this money invested. Charlene if you’re watching this video. You don’t need to book that round-the-world cruise….

Coast Fire example 3 – Sean

Sean, 40, is 28 years away from retirement. If he saves and invests £12,000 per year over the next 15 years to achieve £363k, then leaving the money invested for the next 13 years will allow him to reach his target goal.

As you can see, the older you are, the more aggressively you need to save for your retirement. As the old saying goes, “The best time to plant a tree was 20 years ago, the second-best time is now.” If you’re in your 50s and watching this video, the time to take action is now. But I would also say that this is also the case if you’re in your 40s or 30s.

Types of Financial Independence

Recently, in this series of financial independence videos, I covered Lean FIRE, which I believe is the starting point of the FIRE journey. Lean FIRE provides a level of security and knowledge that our most basic needs are met by our investments. It’s a wonderful achievement and should be celebrated more than it is. While some of us will live a very fulfilling Lean FIRE lifestyle, many argue that Lean FIRE doesn’t provide the retirement they want.

What are the different types of financial independence retire early?

There are stages along the path of financial independence that we can strive to achieve. It starts with Lean FIRE, Coast FIRE and Barista FIRE, which all lead towards Traditional FIRE. But following this, those who continue on this financial journey can aim to achieve Chubby FIRE or Fat FIRE

Here are the different types of FIRE:

- Lean FIRE

- Coast FIRE

- Barista FIRE

- Traditional FIRE

- Chubby FIRE

- Fat FIRE

Lean FIRE is when your investments can indefinitely cover your essential spending and basic needs. It allows for little extravagance or luxury, but many do find the frugality and minimalism rewarding.

Barista FIRE happens when you’ve saved and invested enough to retire, potentially on a Lean FIRE budget, but it can be any level. At this point, some choose to take a lower-paying or potentially less stressful job, such as a barista, to cover some living expenses or afford some of the nicer things in retirement.

Coast FIRE, like many concepts, is open to interpretation. In my opinion, Coast FIRE can happen when our investments will eventually reach a full financial independence amount without further addition of funds, allowing us to coast through to that time. You will still need to fund your current living expenses through employment until your investments grow to a level to meet your eventual financial needs.

Traditional FIRE is the level at which our retirement needs are met, with 25 times our expected spending invested, providing income indefinitely.

Chubby FIRE is for those who want a bit more luxury in their retirement. Some people determine Chubby FIRE as a wealth value, often touted in the $2.5 million – $5 million range. Others argue that those pursuing Chubby FIRE may have a slightly more luxurious lifestyle in their retirement versus their working career.

Fat FIRE is for the higher earners and high net-worth individuals or couples among us. We’re talking about those with many millions invested in assets, who can afford luxurious travel, mansions, and fancy cars. Generally speaking, Fat FIRE is reserved for those with $5+ million in assets invested.

Coast FIRE may not be the end

Coast FIRE is an important step for anyone on their journey towards financial independence. Once your investments reach a level where they will one day grow to cover your regular living expenses, it’s incredibly liberating. While some of you choose to let your investments continue to grow over time, when you reach Coast FIRE you get the choice of whether or not you want to continue investing and building your wealth. To reduce the amount of time it takes until you reach financial independence. This is your journey, and what works for you may not be suitable for someone else.

I remember doing my calculations on my financial independence number and realising that if I left those investments for 20 years, they would meet my financial goals. This was a moment where I realised that my retirement was secure, and if the worst-case scenario happened to my business, or to my wife’s job, we only had to find a way to earn enough money to pay our current bills without any further consideration for our future. With financial security all but guaranteed in my retirement, I doubled down my efforts and focused even more on achieving financial independence.

With Coast FIRE achieved, this is when you start to see your investments really working for you. They are growing and just doing their thing in the background, and any further contributions you make just start to snowball your investments. Eventually, the money that you invest will grow quicker than any further investment you make, and that is the beauty of compound growth over the long term.

Final thoughts

If I were starting out on my journey towards financial independence today, I would give little consideration to the other stages of financial independence and concentrate my efforts on achieving my Coast FIRE number. At this point, the world opens up, flexibility enters your life and you create a world filled with choices. Do you want to change jobs or start a business? Have you always wanted to move abroad? The choice is yours when you are secure in the knowledge that financial independence should one day happen.

No matter what age you are, I recommend looking at your target financial independence number and investing aggressively to achieve this figure as quickly as possible. It may mean that you have to reduce your expenses elsewhere and often these sacrifices feel like great challenges to overcome. But I promise you that you’ll look back five or ten years from now and wish you’d started sooner.