When I was growing up, the limit of my financial education was my parents telling me “To buy only things I can afford in cash”. Looking back, this was a huge life lesson and it has probably shaped my relationship with money to this day. I always had the voice of my dad in the back of my head guiding me on any significant purchase. And even in business, we rarely took on debt. If we couldn’t afford something, we just didn’t buy it, until we could actually afford it.

But most people don’t think like that. The reality of life today is that we have access to nearly unlimited sums of credit and if we want something now, we can generally buy it at a moment’s notice and with little friction. And that’s regardless of whether or not we can actually afford it. This is normal, not because it’s right, but because everyone else is doing it.

Money habits like this are stopping people from getting out of debt or building true wealth. And that’s the purpose of today’s video. In my view, there are 9 “normal” money habits keeping you poor. Most people are making these mistakes without even realising it and today I‘m shining a light on each of these to help you tackle them head-on. If you recognise yourself in any of these scenarios, good. That’s the sign to take action.

Keeping up with the Joneses – Lifestyle inflation

Appearances matter and in a world where trying to look healthy and wealthy is the norm, many of us will get caught up in all of the hype. Fancy cars, big houses and extravagant lifestyles come at a cost. Living the Kardashian lifestyle and being able to afford it are two different things.

Don’t worry. I hear you when you say “But Connor I work hard, I’m entitled to enjoy myself”. And I agree with you. I have nice things and I too have spent the money I’ve earned on luxuries. I’m not for one minute telling you to stop spending money (that’s for a different video). But I always budgeted and ensured that I was not getting into debt or sacrificing my future for them. And if you can confidently say that, then by all means, spend away.

But remember, no one cares as much about you as you do. A few likes on your Instagram story may give you a dopamine rush, but in the real world, it means less than nothing. And just because your neighbour bought a Tesla, got new windows or has added an extension, doesn’t mean you need to.

It’s normal to want more in life and we are bombarded with advertising, TV shows and influence from every direction enticing us to spend more with the aim of being happier. But I’ll be honest with you. Buying things won’t make you happier. Not in the long term and not when it comes at the expense of your future.

Being content with what you have and realising that early on in life will help you break free from one of the most influential negative money habits keeping you poor.

Even those of us who aren’t caught up in the millionaire lifestyle suffer from increased spending. It’s called lifestyle inflation, and it happens with little thought on your part. As our lives mature, we buy a home, families grow and without intentionally planning to spend more, our costs increase. As your income increases, you might decide to spend a little more on memberships, subscriptions or other living costs. It’s normal to spend more when you have more because that’s what normal people do.

But what happens when the money stops coming? If you are living to means, it’s unlikely that you’re putting money away enough money for your future. What will happen if you lost your job or were unable to work? How will you afford this lifestyle in retirement without saving enough now?

Most people don’t realise that drawing down your pension in retirement comes with the most significant pay cut you’ll ever have. Think about this. If you’re spending 90% of your income now and saving 10%, could those savings ever grow to replace your income? The answer is yes, but it would almost guarantee that you need to work into your 70s, having started investing in your early 20s.

Not managing your budget

The answer to lifestyle inflation is of course to manage your budget and this brings me to my second money habit keeping you poor. Budgets are the cornerstone of financial success. I say this because it is absolutely true. So few of us manage our budgets beyond checking our bank balance mid-month and realising we’re running short before our next payday.

Budgets are not sexy and budgets are not cool. By not managing your budget and tracking your finances, you’re leaving everything up to chance. And that will keep you poor.

Budgets are forward-looking. They will shine a light on your finances and keep you focused on the plan for your money.

And I don’t really mind if you track everything down to the last penny or you loosely understand your spending habits. As long as you review these each month and make changes where necessary.

There are two stages of life when it comes to budgeting.

- Keeping your spending less than your income

- Increasing the amount of money you can save, invest or pay down debt.

If you spend more than you earn, you will stay poor forever. Going into debt should be avoided at all costs and starting to budget will identify the reason for this allowing you to take action.

When we build a budget that allows us to stay out of debt, we achieve a level of financial stability. A platform that will allow us to start putting our money to work in our favour. In our second stage of budgeting our goal should be to increase the percentage of our income that we can invest in our future.

- Good = 20%

- Excellent = 50%

- Extreme = 80%

Aiming for a 20% savings rate is achievable for most people, though wouldn’t be without some sacrifices. 50% will virtually ensure you live as you do now in retirement. Possibly better. So far in this video, I’ve talked about lifestyle creep and I’ve also talked about budgeting. But you could increase your savings rate to an extreme level by earning more money.

Funnily enough, this is my third money habit keeping you poor.

Only having 1 source of income

If you’ve watched any of my videos before (thank you), you’ll know that I believe business and entrepreneurship is the quickest and most effective way to achieve financial independence.

I have absolutely no issue with you being employed and building wealth in a normal 9-5, and I have spoken with many people who have achieved significant financial success through doing so. However, I believe that multiple sources of income provide the ability to quickly and securely build wealth.

If you lost your job tomorrow, you might have to dip into your savings or emergency fund. Not ideal. Even worse, you might find yourself in debt. Having 2, 3 or 4 sources of income helps you navigate potential challenges with relative ease.

In the history of time, there has never been an easier or cheaper time to make money. You don’t need employees, nor do you need premises. But the willingness to learn new skills can help you build additional sources of income easily.

And with this additional source of money, we need to put the money to work for us. Investing in the stock market or buying rental properties will help us to balance our income streams and ensure we have the

I have a pretty great article over on foundered.co.uk about the 7 multiple streams of income you can build. Definitely check it out and I’ll put the link in the show notes below.

Not understanding taxes

Taxes are one of the largest expenses in anyone’s budget. As someone who is employed, it’s very easy to assume your taxes are all but taken care of by your company. And for the most part, I’ll agree that they are. As an employee, there are very few ways to legally reduce your tax liability, but this shouldn’t mean you disregard learning about the taxes that affect you.

If you have a company car or other company benefits such as healthcare, do you truly understand the benefit in kind and how this affects your salary?

Wealthy people understand how investing in accounts such as pensions, ISAs or Roth IRAs shelters their money from taxation. All of these are beneficial to understand fully as an employee.

For those who are self-employed or are shareholders of their own companies, understanding taxes and how you can reduce your tax liability easily may be beyond your knowledge. I had a peripheral understanding of many tax elements my business faced, but instead of going alone, I paid accountants I trusted to manage this on my behalf. I can tell you they were worth every penny.

Being cheap

There is a huge difference between being cheap and being frugal. A frugal person will try to buy quality items but will do so in a manner that makes them more affordable. By using discount codes or waiting for a sale. The cheap consumer buys whatever they can find at the lowest price possible.

Spending less on products and services may save you money in the short term, but often this comes at the expense of longevity or quality. And more often than not, these items may need to be replaced more frequently, costing more over the long term.

If I was to talk about fast fashion as an example. Buying cheap clothing will afford you a low-cost t-shirt or jumper to wear out this weekend. But after a few washes, the quality of the clothing deteriorates rapidly. The disposable nature of cheaper items means we don’t think about the lifetime costs of 1 t-shirt versus many, but rather what its cost is to us here and now.

Finding the lowest price for services often means that you get what you pay for and this too can cost you much more later on. When picking your insurance, the cheapest options often come with a higher excess or lesser coverage. Which in the unfortunate case of an accident can cost you significantly more. Try not to choose a plan solely on the price, but based on the benefits coverage and other factors that may affect you.

Not talking about your finances

You’ll have friends who talk about money too much and you’ll have others who don’t talk about it at all. But starting the conversation around money is the first step to understanding it better. Discussing money shouldn’t be bragging about your luxury purchases, but rather talking about topics that benefit each other.

- Pensions – check

- Saving – check

- Reducing costs – check

- Oh look at my new Tesla… Not so much.

You are the average of the 5 people you spend the most time with and learning from each other is the best way to build your knowledge and increase your awareness of topics.

Talking about your finances needs to happen closer to home also and many couples avoid this conversation entirely. In fact, the most common reason why we don’t talk about money is because of the shame or embarrassment they feel about the state of their finances. Baring all for your partner in the bedroom is often much easier than discussing your financial situation. But it shouldn’t be, and talking about your finances, and working it out as a partnership will help you move forward together. Talking about money can reduce relationship stresses or eventual break-ups which are one of the most costly life events that can happen.

Going into debt unnecessarily

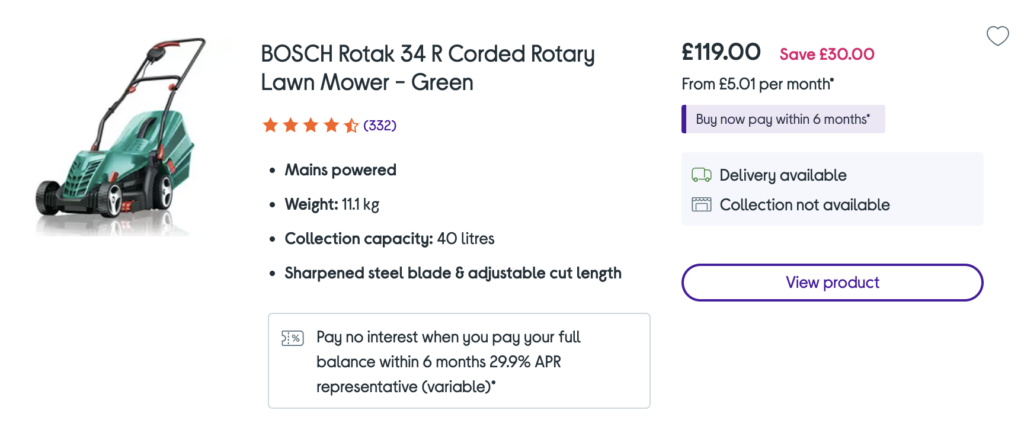

Never in the history of time has it been so easy or normal to access credit for purchases. When you shop online, almost every checkout has a buy now, pay later option.

Buying things and going into debt used to be reserved for high-ticket items such as cars, or homes. But when you can buy a £119 lawnmower for £5.01 a month, using debt to purchase everyday items has become normal.

I’ll go back to the money lesson I mentioned earlier. If you can’t buy it in cash, you can’t afford it. Save the money first, then go buy that item. Thanks, Dad!

Of course, there are some of you who’ll be quick to point out that we’ll “Pay no interest when you pay your full balance within 6 months”. And that’s valid if you are strict enough to ensure this is repaid. But what if an emergency happened and you could not afford the repayment? Further debt is the answer. I promise you this wouldn’t be an option if it was used extensively by customers. The credit companies are not your friend and the fact that they present this offer so prominently, means that many customers don’t pay off within 6 months.

Paying yourself last

The golden rule of budgeting and saving for your future is to pay yourself first. This means with every pay packet or wage that deposits into your bank account, you automatically dedicate a portion towards your savings or investments. Treating your saving like a bill, where it must be paid, ensures you put that money beyond the ability to spend it right away.

The opposite of this is to pay yourself last and to save only what’s left at the end of the month. The problem with this is that by the end of the month, there’s often no money left and saving or investing never happens.

Using your forward-looking budget, always assign a percentage of your income towards your investments. And if possible automate these investments a day or two after your salary reaches your bank account.

Buying things now!

I know many people who are the epitome of impulsive buyers. They see something they like and they buy it without a second thought. A few months down the line, they want something else and change it out or sell it, often at a cost to them.

Being impulsive and buying things you don’t really need can wreck your budget because it’s completely unplanned. It can be something as small as a packet of crisps or it can be walking into a showroom and buying a new jeep.

Almost all of us have fallen into some impulse purchase. Because we don’t always think about the consequence, but rather the excitement of buying something new right now and the motion that comes with it.

I’m not telling you to stop spending money, but if you stick to your budget and plan your purchases then you can avoid impulse purchases that will keep you poor.

Want more like this?

Head over to the Foundered Money Youtube Channel where I cover a heap of awesome topics about money.